What is a travel money card, anyway?

A prepaid travel money card lets you load foreign currency to spend overseas, avoiding foreign transaction fees. It’s not linked to any of your other bank accounts, but works just like a debit card - at shops, ATMs, and online - making it a safer and more convenient option for managing your money when travelling.

Know what you’ve got to spend

Lock in exchange rates~ each time you load in up to 10 foreign currencies: EUR, GBP, USD, NZD, JPY, THB, CAD, HKD, SGD, AED. Or load AUD to use worldwide.

Shop like a local

$0 initial load fee and $0 card issue fee. Plus no international transaction fees on purchases when you load and transact in the same currency.

Travel the world with one card

You receive a physical card, and can use it as you would any other Mastercard card worldwide – in-store, online, or to withdraw local currency at ATMs.

Peace of mind while overseas

24/7 Global Support always means we're always there to help if your card is lost, stolen or damaged, and can replace your card quickly or provide you with emergency cash, wherever you may be+.

Today's exchange rates*

Running low on travel money?

Cash Passport Platinum is reloadable, allowing you to top-up any of your currencies, anywhere, anytime.

You can reload online in three ways:

- Transfer funds from Debit Card (instant)

- Bank transfer (1 business day)

- BPAY (up to 2 business days)

If you purchase your card in-store, you can reload in-person at your original place of purchase.

Keep track of your travel money

You can use your mobile, tablet, laptop or PC to login to 'My Account' and stay in control of your travel money.

Register for 'My Account', so you can:

- Track your spending

- Reload your card

- Transfer between currencies

- Retrieve your PIN number

- Suspend your card temporarily

- Cash out your remaining balance

You can also download the Cash Passport mobile app, available for iOS and Android devices.

Stop lining up, start experiencing more

Enjoy the freedom of ultra-fast contactless payments, with Tap & Go at retail stores, restaurants, convenience stores and more.

Wherever you see the universal contactless symbol, your Cash Passport Platinum is ready to go.

Traveling to London? You can even use your Cash Passport Platinum to tap on and off the London Tube, never having to line up again.

Travel with confidence

Spend securely as your Cash Passport Platinum is protected by CHIP and PIN.

Cash Passport Platinum is secured by Mastercard Zero Liability protecting you against unauthorised and fraudulent transactions, should your card ever be reported lost or stolen.

Looking for a back-up card for safe keeping? Too easy, simply purchase an additional card when ordering online.

We're here to help

We're only a call or email away at all times. Our global assistance team will help you if your card is lost, stolen or damaged.

We can replace your card quickly or provide you with access to emergency cash, so you can keep enjoying your holiday.

Need further help?

View our frequently asked questions or feel free to contact us.

Platinum benefits

Turn a delay into a lounge stay! Enjoy complimentary access to over 1,000 LoungekeyTM airport lounges worldwide when your flight is delayed for 2 hours or more#.

Getting your pass is easy

- Register a flight – Go to Flight Delay Pass to register with your name, flight details, email and mobile number. The flight registration must take place no later than the flight's scheduled departure time

- Flight monitoring – Mastercard tracks flight status and sends you an email and SMS with your lounge passes when a flight is delayed more than 2 hours

- Redeem lounge visit – Simply flash the lounge pass sent by Mastercard Flight Delay Pass to gain lounge access

priceless provides access to unforgettable experiences and valuable discounts when you spend with your Cash Passport overseas, locally and online.

There’s a world of possibilities waiting to elevate your travels. See the pride in your child’s eyes when they stand up on a surfboard for the first time, or their smile when they meet their favorite athlete. Rediscover your love for cooking in the Tuscan hills.

Fuel your passions. Make memories to last a lifetime. Explore your priceless opportunities here.

Get your Cash Passport (fast!)

-

Order online

Select your currencies and verify your identity using your Australian driver’s license or Australian passport.

-

Make payment

Pay for your initial load instantly with Debit Card. Don’t have a debit card? We also accept BPAY.

-

Take delivery

Upon receiving your load, your card will be immediately dispatched to your home address within 3 business days.

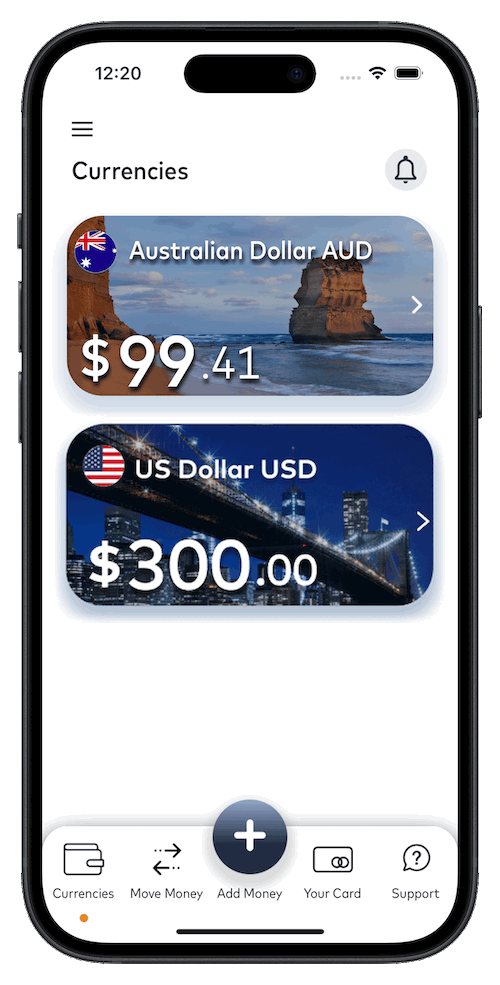

Travel with ease

The Cash Passport app makes managing your travel money faster, easier and even more secure.

|

-

Secure and easy access with Touch ID

Get fast and easy access to your Cash Passport app by using Touch ID. The new fingerprint recognition feature operates using highly secure biometrics and is an easy alternative to using your online password. Even lock or unlock a misplaced card for added protection.

-

Track your activity on the go

Be smart about your money. Monitor all of your activity, whether you’re reloading or transferring funds, it’s all accounted for here in one simple, secure place allowing you to stay up to date with transactions and card spending. Plus includes integrated support screen for frequently asked questions.

-

Move between currencies

Move money between your currencies with just a couple of taps – it’s that simple! Quickly move money between 11 currencies, including EUR, USD, SGD, CAD and GBP and spend more time enjoying your holiday.

Eco certified cards

Concerned about your environmental impact?

The Cash Passport Platinum card contains at least 90% recycled PVC. You’ll know you're helping to reduce the environmental impact of your wallet when you see the Card Eco Certification imprint on your Cash Passport card.

Mastercard established its sustainability efforts more than a decade ago, and continues to develop programs that help consumers contribute to the future of the planet, such as the Priceless Planet Coalition.